A new method can extract sentiment information from analyst reports to help make better investment decisions.

Unstructured text is one of the largest data sources used to communicate investor thoughts and opinions in financial markets. Text data analytics transform these unstructured text data into meaningful data that can provide insights, such as stock market trading patterns. There is increasing demand in the financial sector to utilize text information to guide decision makers in making better investment decisions.

Chen Ying, a professor in the mathematics department at the National University of Singapore, and PhD student Hitoshi Iwasaki developed a text data analytics method for extracting sentiment indices for specific topics from analyst reports of listed companies.

This sentiment extraction, which the researchers based on a machine learning approach, is known as deep neural network supervised learning. A key feature of this method is that it analyses the reports at the sentence level rather than individual words. In this way, the original meaning and context can be more accurately identified.

The research team performed the sentiment analysis on more than 110,000 analyst reports written in Japanese for stocks listed on the Tokyo Stock Exchange and the Osaka Exchange. They then incorporated the sentiments into a topic sentiment asset pricing model.

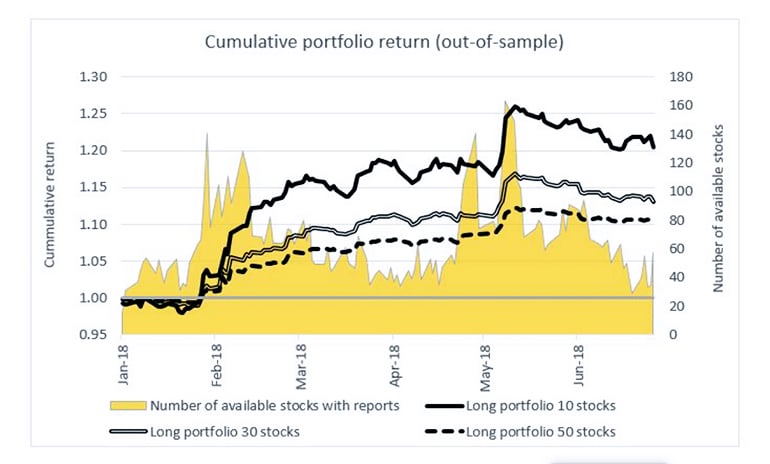

Compared to other asset pricing models which either do not incorporate sentiment analysis or have overall sentiments (single aggregated value), the researchers showed their model has better predictability on expected returns and improved interpretability (contribution of each variable component towards the outcome).

“In our study, we found that topics reflecting the subjective opinions of equity analysts have greater predictability on portfolio returns than topics pertaining to objective facts and quantitative measures,” says Chen.

“This seems to suggest that sentiment analysis could play a significant role in modern portfolio selection.”

Source: National University of Singapore