People who cohabited had less wealth compared to those who never lived together before marriage, a new study finds. The gap in wealth grew significantly for those who cohabited multiple times.

Money or debt can be a common reason for this decision, but there may be long-term financial implications to cohabitation, according to the research published in the Journal of Financial Planning.

Researchers analyzed data from the 1997 cohort of the National Longitudinal Survey of Youth, which included individuals born between 1980 and 1984. Of the more than 5,000 millennials (ages 28 to 34) in the cohort—45 percent were married, 18 percent were cohabiting, and 37 percent were unmarried and not living with anyone.

Cassandra Dorius, an assistant professor of human development and family studies at Iowa State University, says survey respondents who were single but had previously lived with someone more than once fared the worst.

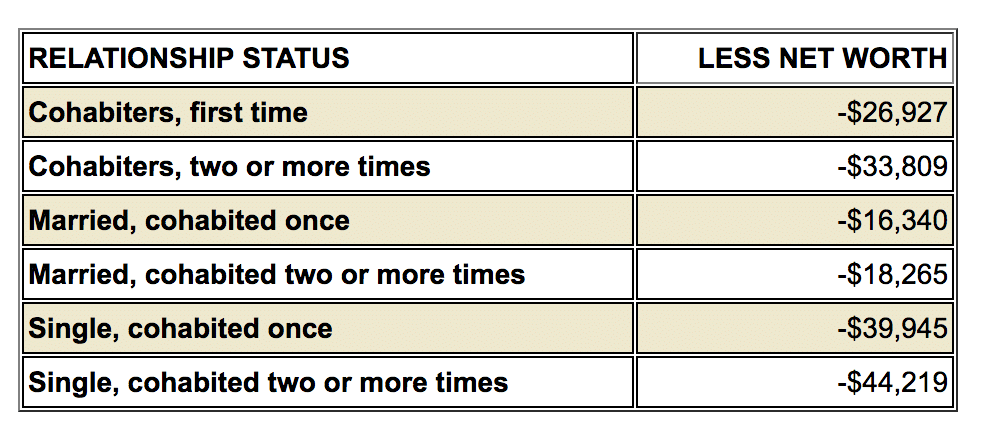

This graph provides a breakdown of net worth as compared to married couples who never cohabited:

“Cohabiting relationships tend to be more short-term and unstable, and you keep starting over every time. That is difficult for wealth generation,” Dorius says.

Why might this be the case?

The data do not explain why the gap exists, but researchers say instability and lack of legal protections likely contribute to the differences in wealth. Dorius says cohabiting relationships tend to be short-term compared to marriage, and if the relationship ends, assets are not split equally as in a divorce.

“We have to embrace the fact that we are not going back to the days when everyone married at a young age and stayed married.”

Sonya Britt-Lutter, lead author and associate professor of personal financial planning at Kansas State University, recommends financial planners ask clients if they are cohabiting in order to advise them on long-term savings and wealth. Britt-Lutter says new client forms only give the option of married, single, divorced, or widowed, without recognizing cohabitation.

“Cohabiters are likely to choose ‘single,’ when in reality the planner should advise them more like ‘married.’ This slight distinction makes a difference because cohabiters are gravitating toward non-financial assets versus longer-term financial asset accumulation,” Britt-Lutter says.

The study does show cohabiting couples are spending money together, but not in the same way as married couples. Rather than buying a house and saving for retirement, cohabiters invest in nonfinancial assets, such as furniture, cars, and boats. Britt-Lutter says treating financial counseling and planning as a regular checkup—similar to going to the doctor or dentist—would help everyone, not just cohabiters.

Time for apartment pre-nups?

Cohabiters may be more inclined to invest and save if there is a formal process to protect those assets, Dorius says. A cohabitation agreement, similar to a prenuptial agreement, is a potential solution. The legal contract would outline how the couple will divide investments and assets if the relationship ends. Given that two-thirds of couples live together before marriage, Dorius says it is an option worth exploring.

Researchers say it is important to consider what will happen in 30 to 40 years when millennials retire. If this trend continues, Dorius says it will put additional strain on programs such as Social Security. That is why change is needed now to educate and help cohabiters accumulate wealth.

“There is no reason why we shouldn’t be forward thinking, acknowledge how cohabitation is affecting wealth and start dealing with it,” Dorius says. “We have to embrace the fact that we are not going back to the days when everyone married at a young age and stayed married. We are in a new world and we need to think about what that means in practical ways.”

Source: Iowa State University